The AI Business Case CFOs Approve in 2026

January 26, 2026

CFOs are exhausted by AI pitches. After a year of pilots that overpromised and underdelivered, finance teams want proof, not potential.

How do you get an AI budget approved for 2026? Bring three numbers—cost avoidance, efficiency gains, and revenue recovery—then support them with a conservative calculator and a 90-day pilot plan.

The good news? Three organizations have already proven the math. They got funded, implemented, and delivered measurable returns.

Here’s how the funded teams built it: a CFO-ready ROI model, a simple calculator, and a 90-day approval path.

What do CFOs need to see to approve AI budgets in 2026?

Verified ROI from similar teams, tied to your own baseline.

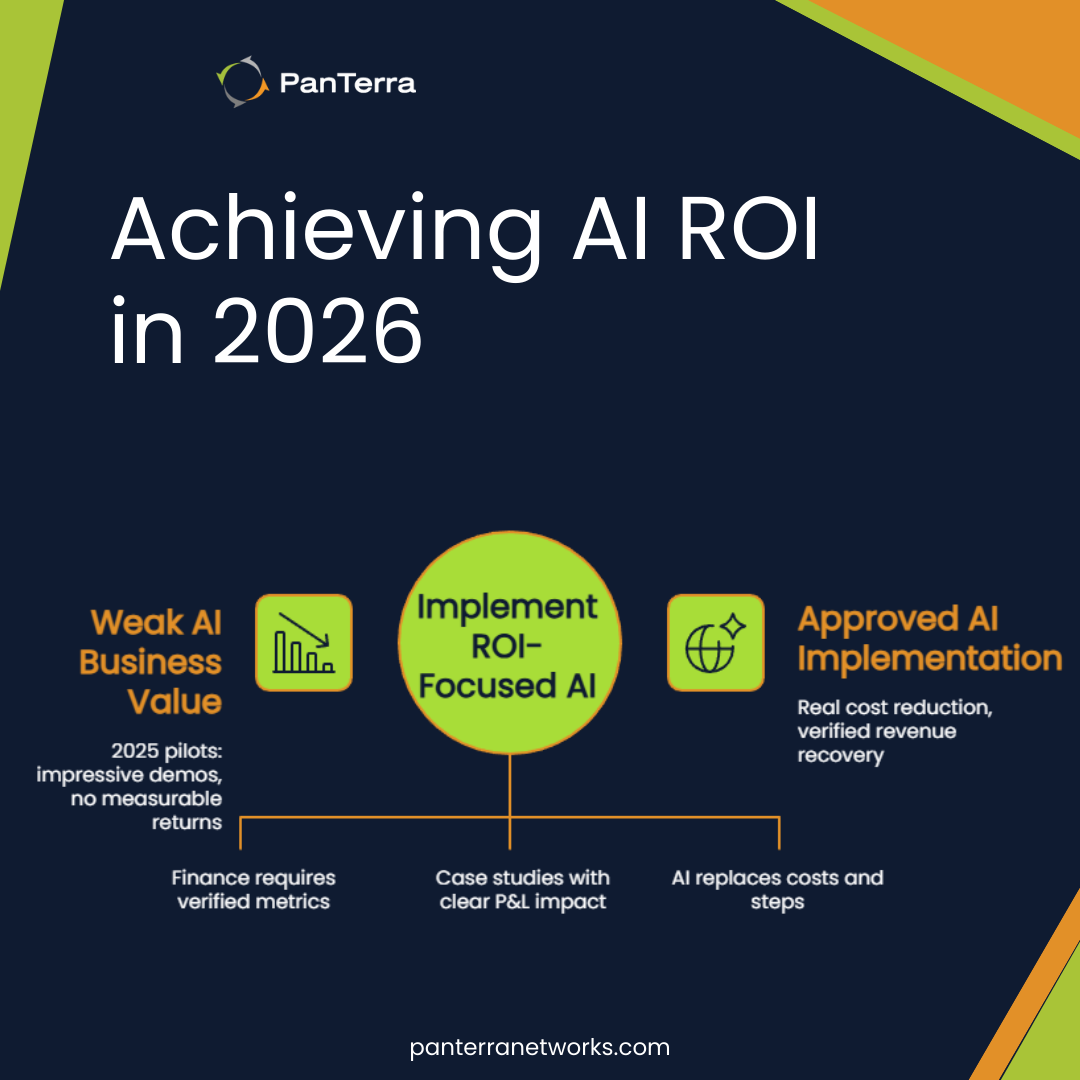

The lessons from 2025 changed how finance evaluates AI investments. The shift from experimentation to accountability happened faster than expected.

How do CFOs separate AI hype from real ROI?

They look for audited outcomes, not pilot promises. 2025 was proof-of-concept year. Everyone tested AI capabilities. Most discovered impressive demos don't equal business value.

2026 is proof-of-return year. CFOs now require verified metrics from comparable organizations. They want case studies with real P&L impact.

The organizations getting funded show numbers. Not projections. Not estimates.

AI That Reduces Cost vs. AI That Adds Tools

CFOs won't pay for more complexity. They pay for fewer moving parts.

The AI investments that failed added new dashboards, new logins, new processes. They increased operational overhead while promising efficiency.

The successful implementations replaced existing costs. They consolidated tools. They eliminated steps. The net result was fewer systems, not more.

The Budget Risk of Doing Nothing

Your competitors are already testing this. The longer you wait, the more expensive the gap gets.

The cost compounds daily. Manual processes consume premium wages. Abandoned interactions accumulate. Customer expectations rise while your capabilities stay flat.

Finance teams know waiting has a cost too.

The 3-Part ROI Model

Successful AI business cases follow a consistent structure. They address three value categories that CFOs universally recognize.

Cost Avoidance

Start with positions you won't need to fill. Calculate fully loaded costs including benefits, training, and management overhead.

Exact Sciences automated work equivalent to 15 full-time positions. Staff was redeployed to higher-value activities. No layoffs, just smarter allocation.

Include overtime reduction. Include temporary staffing avoided during peak periods. These are budget lines you can reduce or avoid.

Efficiency Gains

Time saved translates to capacity gained.

In environments where AI is embedded into cloud communications platforms like PanTerra Streams.AI, efficiency gains come from better routing, faster resolution, and fewer abandoned interactions, not from adding new tools.

Calculate current handle times, then project improvements.

Healthcare organizations report 22 seconds saved per call through automated information retrieval. Multiply by daily volume. The hours add up quickly.

Also count training time, errors, and escalations. They show up in cost per call.

Revenue Recovery

Abandoned calls represent lost revenue. Calculate your current abandonment rate times average transaction value.

US Radiology recovered $4M in three months. They captured 25% more calls through intelligent routing and callback options.

Penn Medicine reduced abandonment from 35% to 20%. Each recovered interaction meant booked appointments and fewer lost requests.

How do you calculate AI ROI for a CFO?

Use your baseline, then model cost avoidance, efficiency, and recovered revenue. Skip the complex models. Use this straightforward framework that finance teams actually trust.

Plug in Your Numbers

Create a simple table:

- Daily call volume

- Current cost per minute

- Abandonment rate

- Average transaction value

Multiply abandoned calls by transaction value. That's the revenue leak.

Calculate agent time on routine tasks. Multiply by loaded hourly cost.

Add positions you're planning to hire. Consider if AI changes that requirement.

Conservative Projections

Cut your estimates in half. Then reduce them again. Conservative numbers that deliver beat aggressive projections that disappoint.

Use phased assumptions. Month one delivers 25% of target. Month three reaches 50%. Full value only after six months.

Include implementation costs. Include training time. Include the learning curve. Realistic timelines build credibility.

What to Show on Slides 1-3

- Slide 1: Current state costs. Real numbers from your operation.

- Slide 2: Comparable results. US Radiology's $4M. Exact Sciences' 15 FTEs. Penn Medicine's abandonment reduction. Verified outcomes from organizations like yours.

- Slide 3: Your conservative projection. Phase one ROI only. Additional phases as upside.

Keep it simple. Three slides tell the story.

Your 90-Day Approval Path

- Week 1-2: Establish baseline metrics. Document current costs, abandonment rates, and handle times.

- Week 3-4: Identify comparable organizations. Get case studies with verified results. Build your benchmark portfolio.

- Week 5-8: Run a limited pilot. Real data from your environment beats any projection. Even small-scale results provide proof.

- Week 9-10: Document pilot outcomes. Calculate actual vs. projected. Identify surprises and adjustments.

- Week 11-12: Present to finance. Lead with pilot results. Follow with conservative scale projection. Close with implementation timeline.

The key is showing progress at each stage. Finance approves what they can track.

Ready to build your business case?

PanTerra offers a complimentary AI ROI assessment for finance teams. We’ll run the numbers with your real metrics.

No guesswork. Just numbers that work.

FAQ

What metrics should I show a CFO for AI ROI?

Show cost avoidance, efficiency, and recovered revenue. Tie each to a tracked line item.

How fast can AI pay back in a contact center?

Prove value in a 60–90 day pilot. Forecast gains in phases, not all at once.

What’s the safest way to forecast AI savings for 2026?

Start with your baseline, then cut projections by 50%. Conservative beats optimistic.

What should a 90-day AI pilot include?

Baseline metrics, one high-volume use case, and weekly measurement. If it can’t be tracked weekly, it’s too broad.

Why do AI business cases get rejected?

Because they rely on generic benchmarks or skip a pilot. CFOs approve what they can verify in your operation.

.jpg?width=500&height=500&name=Are%20you%20Getting%20a%20Good%20Deal%20(1).jpg)

Comments